The Ultimate Plan

|

Your Ultimate Plan Will Be Unique and Perfectly Suited to a Pinnacle of Venture Success.

From Idea to Effective Operations, there is no substitute for success: Guiding and enabling the effective transition of venture and product ideas to practical products that can be scaled, mass-produced and distributed with high value-added margins.

That is the true definition of a Power Success.

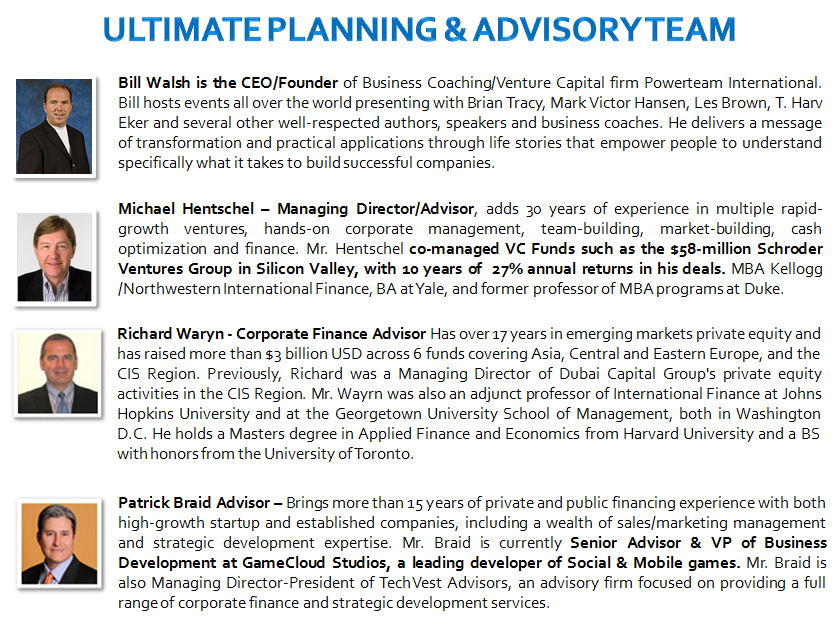

Powerteam International has teamed with Michael Hentschel, Venture Capital fund manager and former professor at Duke University’s “Fuqua Executive MBA program” to provide turn-key business/operating plans, private placement memoranda and comprehensive financial models to enhance the probabilities of funding success.

Hand crafted and created by a seasoned Venture Capitalist with a history of evaluating and analyzing thousands of business plan and financial models over the course of his career, and selectively funding only about one out of every 1000. THAT is selectivity, and THAT is what conventional business plans are up against.

You only hear about the venture companies that receive funding, you never hear about the 99% that do not get funded. Why? Are all those ideas dead on arrival or just dead as read? Most ideas are good, they are simply not yet readied for prime time. And that’s good: competition winnows out the weak. Except when it also winnows out the good ideas for want of intelligent presentations.

© 2013 UltimatePlan.net and PrimaPlan.com, and TechVest.com All Rights Reserved.

Successful Business Plans:

As investment fund managers and venture operating team members, TechVest Principals have reviewed more than 6000 Business Plans and advised more than 100 Ventures and Venture Capital Funds, notably the following:

Investment Banking & Venture Capital Management

- Confluence Ventures TX - Water Investment Pool - partnership

- Parakletos Ventures CA - $10m Fund – investor and diligence analyst

- Santa Clara Ventures CA - $20m Fund – advisor and diligence analyst

- Schroder Ventures CA - $58m Fund – partner, investor, diligence manager

Bio- and Medical Ventures

- Circon Arthroscopy CA - mezzanine investor and diligence, IPO, $3m and diligence

- Family Health Network - $6m partner funding round in preparation

- Mycogen Plant Genetics CA – first round VC investor and Board, IPO - $2m equity and $3m partnership

- Pilot Nutraceuticals NC – advisor - $3m funding and diligence

- ProCyte Wound Healing WA – Board first round VC lead investor, IPO - $2m and diligence

- Raytel Medical Imaging CA – Board, first round VC investor - $2m and diligence

- Telios Wound Healing CA – advisor and due diligence

- Ultrafine Nano-Materials NC – advisor/diligence, interim CEO

- Wellcare Wellness Software NC - founder and architect, seed funding

Telecommunications Ventures

- Advanced Compression Tech CA – advisor/diligence - $2m invested

- Applied Optoelectronics CA – advisor/diligence - $3m invested

- BR Communications CA – investor/diligence - $3m raised

- Desktone, Inc. Virtual Desktops – CFO, first 4 execs, $17mm raised

- Eon Network Management CA – investor/diligence - $1m invested

- Innovacom MPEG2 Video CA – EVP, chief planner - $10m raised

- Phylon Communications CA – Board advisor - $2m invested

- ROLM Communications Corp CA – treasury mgr, budget director - $11m raised

- Silicon Recognition CA/France – advisor/diligence - $6m sought

- Steeplechase Broadband Channel –startup CFO, fund raising advisor

- Stratacom ATM Networks CA (now Cisco) – stage 0 investor, Board advisor - $1m

- Telebit Communications CA – Board investor - $2m invested

- XCI-Fluoroware RF Communications CA – Board investor - $1.5 m invested

Software and other Entrepreneurial Ventures

- ARIO Storage Networks CA - $10mm funding project and diligence

- APEX Analytix Software NC – sales acceleration and $6m project

- Avaterra Virtual Worlds CA – COO-CFO - public-listing buyout - $5.6m raised, IPO

- Borland Applications Software CA – communication software division mgr

- BusLogic SCSI CA – advisor/planner - $1m raised

- ColdStorData Archiving MA - CFO - $200k raised

- Furndex b2B NC – Board/Founder - $4.5m raised

- Global VR Entertainment – advisor, $5m funding advisory

- Imagen Laser Printing CA – lead investor/diligence - $2m raised

- IntelliSeek Metasearch OH – advisor/investor/diligence – angel capital raised

- Internolix e-Commerce Germany - President - $4mm USA, $85m Germany

- Lacrosse Entertainment Gaming Technology - business planning, start-up funding in progress

- Modular Architecture Database Systems CA – EVP biz dev - $17m partnership raised in Japan

- Micro-MRP Manufacturing Software CA – biz dev advisor

- Neuro-Fission Intuitor Predictive Analytics NC - Strategic Advisory Board

- Portfolio Workgroup Technologies CA – CFO - $4m raised

- Resilience Security Appliances CA – CFO - $10m raised

Other Entrepreneurial Ventures

- Advanced Water Treatment Solutions - re-structuring, diligence, CFO - fund raising in progress

- ePAC Print Automation CA – diligence, business plan, $12m round raised

- Garments Dryclean Tellers – diligence, co-Founder, CFO - $1m raised

- ideamille Social Idea Network - co-Founder, regional entrepreneurial idea team building, coordination

- Nussbaum Center for Entrepreneurship - entrepreneurial advisory services - 65 companies

- XelAqua - co-Founder, water cleansing technology for fracking and remediation - re-star

International Expansion Implementation

- EPIC Electric Motors and Generators – fund raising advisor

- Fiberstars Lighting CA – created first European Distribution channels

- LSI Logic CA – established European Finance Center - $7m raised, diligence

- Raychem Components & Materials CA – established European Finance Center

- Remington Sports NC – VP Sales $425m, established Switzerland Finance Center

- Trinity Consulting – established multi-client Germany & France Distribution Networks